Micro Credit

Background

The MBOSCUDA microcredit scheme was conceived in 1998 within the framework of the “Growing from within program” but only became operational in the year 2003 considering the detailed baseline survey and strategy design carried out during the period. The scheme was initiated on the background of the many economic and social problems encountered by the Mbororo women of Cameroon that seriously impede their development.

Faced with problems related to limited access and control over productive resources including income, biased cultural environment, religious misinterpretations and gross gender discrimination, the Mbororo women are increasingly marginalized and subject to extremely high dependency on men in all aspects of their livelihood. They are relegated and limited to the less vital economic activities like milking of cattle and milk processing into butter, while men patronize huge income generating activities like cattle rearing and marketing as they undermine the ability and status of women and therefore determine the local politics of the household and community.

- The micro-credit scheme was therefore conceived to empower the Mbororo women economically to secure their day-to-day needs and hence socially and politically to influence issues in key areas of their lives. Initially, the scheme targeted 20 Mbororo communities in N.W. Cameroon and has now been extended to include some 20 more communities in view of effective engagement. Overall, 22,800,000frs was secured as loan capital and provided as loans to 34 groups within these communities for 10 years to carry out different types of Income Generating Activities (IGA).

Credit model and perspectives

The micro-credit scheme is based on artrism or the welfarist approach of micro-finance. It is conventionally referred to as the Credit-First approach however, with a strong focus on adult literacy using the REFLECT and PRA approaches. The program is designed towards bridging the gender gap in Mbororo communities especially in the domain of decision making and social empowerment aimed at challenging perceptions vis-à-vis the status of Mbororo women. The scheme is not business oriented but geared towards attaining a high social objective. It is therefore strategically situated in the conflict between outreach and sustainability.

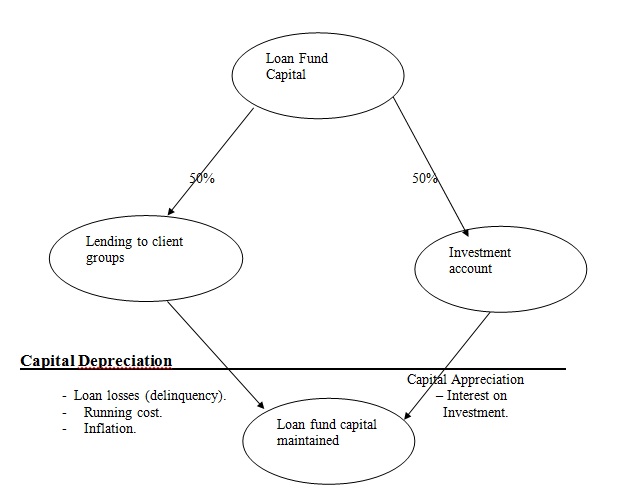

It is on the basis of this target that the scheme has little affinity for collaterals, as a prerequisite for credit delivery but strives to build practical entrepreneurial skills and credit worthiness in clients as alternative social guarantee and value. A strong attention however is given to savings, building on the traditional structures, systems and approaches of savings mobilization and capital formation in groups and communities. The savings component of the scheme includes a voluntary savings and an obligatory savings (10% of loan) Due to religious prerogatives, loans are apparently provided on a free interest terms but groups however make a contribution of 10% usually sourced from and equivalent to obligatory savings to sub vent the running of the scheme. In addition to micro loans and savings, the scheme also provides financial related services like trainings, advice in business management and counseling in case of business failures. The scheme is heavily subsidized considering that group contribution cannot service the high cost of running the scheme. In order to sustain the loan fund capital, the scheme uses the strategy designed below:

Capital depreciation < capital appreciation.

The scheme is very vigilant on loan delinquency which is being addressed through regular monitoring and support to group activities. In fact, the loan recovery rate ranged from 87%-96% for a duration of 10 years and this was considered as a very successful scheme indeed.

Through REFLECT, the scheme is also able to generate and share learning amongst groups that facilitate the successful realization of their loan activities.

Loan delivery framework and procedures

- Loan delivery framework.

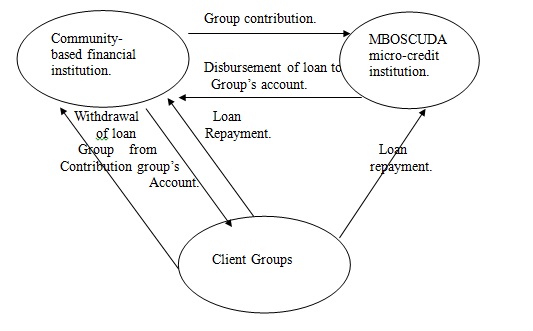

The loan delivery framework has three key actors: client groups, community based financial institutions, micro credit institution (MBOSCUDA), with distinct rules in the delivery mechanism.

- loan delivery procedures

- Sensitization of groups/communities on the micro credit scheme.

- Identification of potential groups using the cash poor household index.

- Groups applies for a loan. A participatory project identification process carried out with groups.

- Feasibility study of project carried out with groups using REFLECT and loan application file completed.

- Planning carried out with groups using planning kit.

- Appropriate technical training carried out on identified project.

- Credit committee held to approve files or reject files for review.

- Disbursement carried out.

- Monitoring and evaluation of group project.

- Recovery, review and recycling of loans

- The scheme has a business plan and a clear monitoring information system that streamline the delivery procedure.

- Loan policies/conditions.

Loan ceilings: 500000 and 1000000 for 1st and 2nd loans respectively

Maximum loan cycle per year: 2.

Loan duration: 2years.

Eligible credit line: agriculture, petit trading, livestock production (except cattle), artisanal (craft).

Eligible group membership: 5 – 35 with CIG status.

Other group obligations: 10% contribution and effective participation in learning circles.

II. Skills and Enterprise Development

The skills and enterprise development sub–component is aimed at building technical and entrepreneurial skills of women in target groups. In light of this objective, women across 34 groups have acquired training and are effectively running market oriented units in various aspects. Generally, the different trainings done with the women are on leadership, group dynamics, functional adult literacy (REFLECT), enterprise development, agriculture & project impact monitoring. This has given women the necessary capacities and skills which also contributed to the very high loan recovery rates of 87% – 96% for a period of about 10 years.

Make A Call

Our Location

MBOSCUDA National Executive Bureau B.P 1086, Yaoundé-Cameroon

MBOSCUDA Building, Old Town,

P.O Box 221, NWR, Bamenda – Cameroon